Down Payment Calculator How much should you put down?

Table Of Content

Homeowner's insurance is based on the home price, and is expressed as an annual premium. The calculator divides that total by 12 months to adjust your monthly mortgage payment. Average annual premiums usually cost less than 1% of the home price and protect your liability as the property owner and insure against hazards, loss, etc.

VA loan and USDA loan: Zero percent down payment

You should also consider other expenses, such as utilities, maintenance, and HOA fees, when determining how much home you can afford. Additionally, lenders may have their own requirements and guidelines, so it's best to speak with a mortgage professional to get a more accurate estimate based on your unique situation. You’ll likely need to make about $75,000 a year to buy a $300K house. This is an estimate, but, as a rule of thumb, with a 3 percent down payment on a conventional 30-year mortgage at 7 percent, your monthly mortgage payment will be around $2,250. Keep in mind this figure doesn’t include home insurance or housing expenses.

Bank accounts

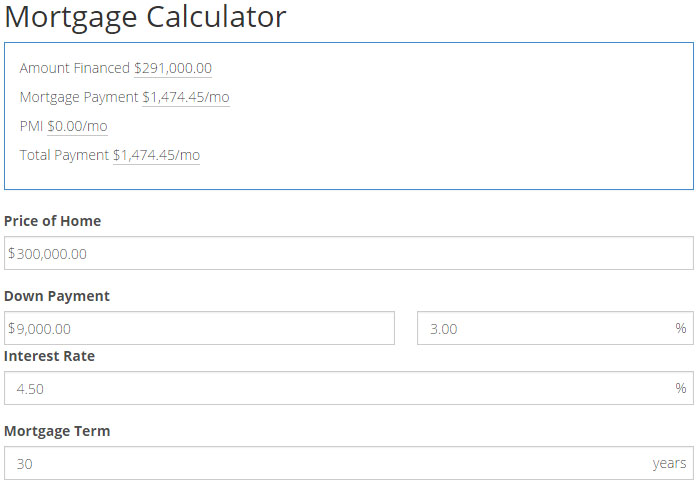

Keep in mind, too, that to avoid PMI, you’ll need to put down at least 20 percent. If you can’t afford that high of a down payment, though, know you won’t pay PMI forever. Once you reach 20 percent equity in your home, you can request that your lender remove PMI from your bill. Offered by some companies, EAH programs can include direct financial assistance, favorable lending terms, or even outright grants. You can buy a $300,000 house with only $9,000 down when using a conventional mortgage, which is the lowest down payment permitted, unless you qualify for a zero-down-payment VA or USDA loan. To be eligible for a USDA loan, your household income must be low to moderate and below the area median income (AMI) where you intend to purchase.

Take your smart money habits to the next level

For more information about or to do calculations involving CDs, please visit the CD Calculator. For a conforming loan on a $300,000 house, down payments can range from 3% to 20% or more, equating to $9,000 to $60,000 or more, respectively. Adhering to the guidelines set by Fannie Mae and Freddie Mac, conforming loans are appealing for their competitive interest rates and flexible guidelines.

Cheapest Islamic mortgage IslamicFinanceGuru - IslamicFinanceGuru — Islamic Finance Guru - Islamic Finance Guru

Cheapest Islamic mortgage IslamicFinanceGuru - IslamicFinanceGuru — Islamic Finance Guru.

Posted: Tue, 31 May 2022 07:00:00 GMT [source]

Making a large down payment reduces your monthly payment, especially if you can reach 20% down. This eliminates mortgage insurance, lowering your overall payment considerably. Our calculations for the income needed to buy a $300k house assume you have around $600 (or less) in other monthly debts. If your recurring payments are higher, you'll need more income to qualify for a mortgage. Our calculations for the income needed to buy a $200k house assume you have around $400 (or less) in other monthly debts. Investing can be as easy as using a robo-advisor to automate your investing or as hands-on as opening your own brokerage account.

The Bankrate promise

The size of your down payment is a percentage of the home price, rather than a dollar figure. So the price of the home dictates how much the down payment should be. To ensure a smooth homebuying experience, seek out a local real estate agent who knows the ins and outs of your area.

Check out today’s mortgage rates.

Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment. Bankrate’s mortgage calculator can help you figure out the income needed to afford a $300K house.

First and foremost, the Federal Housing Administration (FHA) allows borrowers with credit scores as low as 580 (or 500 if able to make a 10% down payment). Unless you are lucky enough to be able to make an all-cash offer, California buyers will need to save up a sizable portion of funds for a down payment when using mortgage financing. Once all of your monthly payment calculations are complete and your finances are in order, you can check whether a mortgage on a 300k house is a realistic goal in your area. $300,000 will go farther in some areas than others, which will affect your home search. By this point, you should have a pretty good idea of how much income you need to buy a home for $200k, $300k, or $400k, although your actual figures could vary.

Just by looking at these states, you can see that a $300k house is reasonable in some areas but not others. Tennessee might seem affordable, but housing prices in Nashville are exceptionally high compared to the rest of the state. The same can be said for Portland in Oregon compared to other parts of the region. But some fared surprisingly well, leveraging opportunities the market presented.

It’s not Boardwalk or Park Place, but NIS 300,000 puts you in Israel’s property game - The Times of Israel

It’s not Boardwalk or Park Place, but NIS 300,000 puts you in Israel’s property game.

Posted: Fri, 23 Sep 2022 07:00:00 GMT [source]

The minimum down payment is used to secure a mortgage by letting lenders know that you can financially support mortgage payments. The minimum down payment on a house is 20% of the total purchase price for general conventional loans. However, there are many situations where the minimum down payment amount varies due to the type of loan taken and if it is within conforming loan limits set by the Federal Housing Finance Agency. For example, first-time home buyers can have minimum down payments of as low as 3% through conforming loans like Fannie Mae’s HomeReady Program or Freddie Mac’s HomePossible Program. If you can put 20% or more down on a conventional loan, you can avoid paying private mortgage insurance.

Lenders scrutinize your credit score, gross monthly income, and debt obligations to gauge your eligibility for a home loan, which hinges on your financial circumstances. For example, if you purchase a $1,500,000 home in La Jolla, expect to make a down payment of at least $225,000 to $300,000 on average. While some buyers want to put more money down to reduce monthly payments, many first-time homebuyers in California ask how they can reduce their initial down payment.

Comments

Post a Comment