What Income Do I Need To Afford A $300K House?

Table Of Content

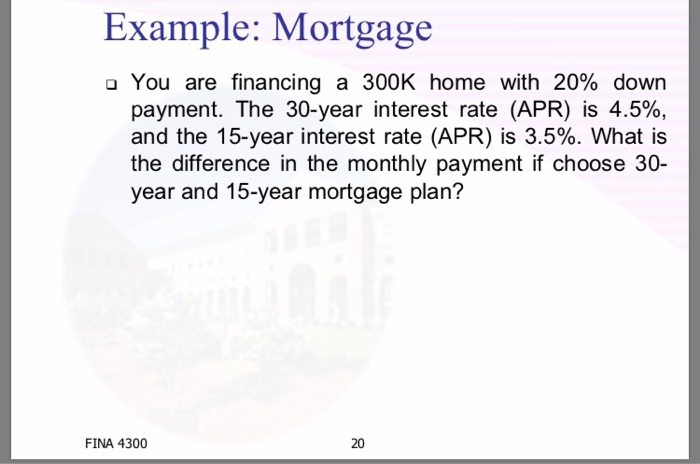

Buyers emboldened by a commission rebate can make higher offers or use the funds to replenish their savings after their down payment. You can pay off your mortgage more aggressively and own a larger percentage of your home faster, but will have a higher bill each month. The term covers the time it will take for you to pay off your loan. One example calculated the mortgage differences on a $180,000 loan. A one percent interest rate increase resulted in the buyer paying $37,000 more in interest over the loan.

Comparing Loan Terms: 30-Year vs. 15-Year

Keep in mind that if you have consumer debt payments, your salary requirement would be larger. Conforming loans, overseen by Fannie Mae and Freddie Mac, generally permit DTI ratios up to almost 50%. This means that as much as half of your monthly gross income can be directed towards debt repayment. However, it’s important to note that conforming loans adhere to maximum loan limits that can vary by county. Explore mortgage options to fit your purchasing scenario and save money.

Bank accounts

Here's how much home $300000 will buy you in every US state - CNBC

Here's how much home $300000 will buy you in every US state.

Posted: Fri, 12 May 2017 07:00:00 GMT [source]

If the amount of upfront cash available and down payment percentages are known, use the calculator below to calculate an estimate for an affordable home price. We are committed to reinventing the mortgage lending model in order to provide outstanding service, low rates, and some of the fastest closing times in the industry. By thoroughly researching and comparing your mortgage loan options, you’ll be prepared to make the best financial decision for your situation. The length of the loan and the interest rate you qualify for will determine how much you pay in total interest. For example, if you opted for a 15-year mortgage with a 7% interest rate, you’d pay a total of $485,367 versus the $718,527 you’d pay with a 30-year mortgage at the same interest rate.

Conforming loans vs non-conforming loans

$300K Is the 'New $100K' in NYC. Here's How Taxes and Costs Affected U.S. Cities in 2023 - Yahoo Finance

$300K Is the 'New $100K' in NYC. Here's How Taxes and Costs Affected U.S. Cities in 2023.

Posted: Mon, 19 Feb 2024 08:00:00 GMT [source]

Use this down payment calculator to help you answer the question “how much should my down payment be? With a larger down payment, you won’t have to borrow as much mortgage to complete the purchase of your home. On the surface, this means you’ll have a lower monthly mortgage payment and save real money on interest charges. This also might keep you from taking on more debt than you can handle.

That would be the case for home loans that don’t require a down payment, such as VA loans and USDA loans. IRA—The principal contributed to a Roth IRA (individual retirement account) can be withdrawn without penalty or tax. In contrast, contributions from a traditional IRA will be subject to regular income tax as well as a 10% penalty if the contributions are withdrawn prior to the age of 59 ½. The funds can also legally be used to purchase a home for a spouse, parents, children, or grandchildren. The only caveat is that the home-buyer is only given 120 days to spend the withdrawn funds, or else they are liable for paying the penalty.

Use the Home Price

The USDA’s automated underwriting system requires a 640 credit score for automatic approval. However, some USDA lenders might consider scores below 640 with compensating factors in place. These could include a lower debt-to-income ratio (DTI) or making a down payment. Remember that every journey to homeownership is unique, especially when arranging the down payment for a $300,000 house.

However, down payment assistance programs can be a significant amount and should not be overlooked if you are low on cash. Census Bureau’s 2019 American Housing Survey, the most common source of down payment is from savings or cash on hand. Savings or cash was the primary source of down payment for 44.2% of homebuyers in 2019. The second most common source is from the sale of a previous home, which was the primary down payment source for 27.7% of homebuyers. Other common sources include borrowing a down payment, an inheritance or gift, or from the sale of investments.

How much income do I need to afford a $300k home?

Employees should inquire with their HR department about the availability of such housing benefits. This involves showing the source of funds and the money leaving from your donor’s account to yours. The key lies in choosing the down payment amount that aligns best with your circumstances. Home prices have also remained relatively steady, meaning that those who can still afford a home need to readjust their budgets, while others have been priced out.

Bankrate logo

An agent can help you find properties that meet both your needs and your budget, and can guide you through the entire process with professional expertise. Another example is Presidential Bank's Advantage Checking account. You need to have a minimum balance of $500, have a monthly deposit of at least $500, and at least seven withdrawals per month in order to earn a 2.25% APY on your balance of up to $25,000. One example of a high-yield checking account is T-Mobile's MONEY Checking account. By maintaining a minimum balance of $3,000, having a T-Mobile wireless plan, and making at least 10 purchases with your debit card, you can earn a 4.00% APY on balances up to $3,000.

In Los Angeles, the high cost of housing has also played a role in making it the most overcrowded large U.S. county. New venture capital firms, like Fifth Wall Ventures, have begun a dedicated approach to investing in real estate technology startups that are transforming what they refer to as the "Built World". Check out FastExpert to find an agent who can help you buy a $300k house.

This is the most traditional option and requires you to put down $60,000 as a down payment. With a 20% down payment option, you may qualify for a better interest rate and avoid paying private mortgage insurance (PMI). As you explore options for financing the down payment for a $300K house, it’s important to consider a variety of resources.

Comments

Post a Comment